Value Betting Simulator With Variance Visualization

Equity Curves Variance

Sample of Monte Carlo paths visualizing potential outcomes.

Detailed ROI Quantiles

Tail outcomes and typical path levels.

Probability Insights

Quick read on survivability and tail risk.

Ending ROI Distribution

How outcomes spread across all trials.

⚠️ Important Legal & Risk Disclosure

This page is for educational and analytical purposes only.

Betting laws and availability vary by jurisdiction.

Tools shown here do not guarantee outcomes or financial results.

How to read and use the value betting simulator?

Here’s a quick glossary for each control/output in your expectancy-based betting simulator:

Inputs (how the sim runs)

- Number of Bets: How many bets do you want to simulate in a row. More bets simulate a longer ‘season,’ allowing you to observe how a bankroll may fluctuate over time under different conditions.

- Mean Offered Odds (decimal): The average odds you’re getting from the bookmaker. In decimal odds, 2.50 means you get 2.5× your stake back if you win (so a $10 bet returns $25, profit $15). This is just the “typical” price; with dispersion turned on, it can wiggle around.

- Mean Edge / EV (%): Your average advantage per bet. If EV is +5%, it represents a theoretical average outcome of $5 per $100 wagered over a very large number of trials, based on the assumptions used. It does not imply consistent wins and does not remove uncertainty or short-term losses.

- % Bankroll Stake: If you choose “Percent” staking, this is what slice of your current bankroll you bet each time. For example, 1% on a $1,000 bankroll is a $10 bet; if your bankroll grows to $1,200, 1% becomes $12. It scales up and down automatically.

- Kelly Scale (0–1): A sizing rule designed to balance theoretical growth with risk control based on mathematical assumptions. 1 is full Kelly (aggressive), 0.5 is half-Kelly (safer), 0 would mean no Kelly at all. Most people use less than 1 to avoid big swings.

- Monte Carlo Trials: How many alternate “parallel universes” the simulator runs. Each trial is a different random path. More trials provide a broader view of possible favorable, typical, and adverse outcomes.

Realism knobs in betting simulation (make it closer to real life)

Odds Dispersion (lognormal σ, %)

How much the odds bounce around their average. 0% means the odds stay the same; higher % means sometimes you’ll get slightly better or worse prices, like in real betting, where odds change.

EV Std Dev per bet (%)

How much your estimated advantage (your advantage) changes from bet to bet. In real life, some picks are stronger and some are weaker. A higher number means more variety in how good your bets are.

Clamp EV to [%min, %max]

Sets hard limits so your edge doesn’t go crazy. For example, -20, 40 means the simulator won’t let your EV be worse than −20% or better than +40% on any single bet.

Autocorrelation ρ (0–0.95)

This controls streakiness. With 0, each bet’s quality is independent. With a higher number (like 0.6), if you’re on a “good run,” it tends to stay good for a while (and same for bad runs). It models streak-like behavior that can occur due to outcome dispersion.

Shock Std Dev (%)

How big each new “push” to your estimated advantage is from one bet to the next. Think of it like the daily ups and downs added on top of your average edge. Bigger shocks = choppier ride.

RNG Seed (optional)

Type any number to freeze the randomness. Using the same inputs and the same seed gives the exact same results again—handy for sharing and checking.

Risk limits

Stop-Loss (% of bankroll)

A risk-control parameter. If your bankroll drops by this percent from the start (say 50%), the simulator stops that run. It models you saying, “I’ll quit if I’m down too much.”

Take-Profit (% of bankroll)

A predefined stopping point for simulation purposes. If your bankroll grows by this percent (say +100%), the sim stops that run to show what happens if you take the money and walk away.

View toggles

Show Curves

Shows a handful of example bankroll paths over time. It’s like watching a few possible journeys your money could take.

Show Quantiles

Shows three lines: 5%, 50% (median), and 95%. Together, they form a “confidence envelope” that shows likely low, typical, and high bankroll levels at each step.

Show Histogram

Shows a bar chart of final ROI (your ending profit as a percent of your starting bankroll) across all the trials. It’s a snapshot of how often each ending result happens.

What are “Equity Quantiles (5% / 50% / 95%)”?

Imagine all your trials lined up at bet #50, or bet #200. The 5% line is where only 5 out of 100 runs did worse than that value (a bad-case line). The 50% line is the middle (half did better, half worse). The 95% line is where only 5 out of 100 runs did better (a great-case line).

Together, they show your likely range as you go along, not just the final result.

How to analyze the Final ROI distribution

Where is the center?

Look at the median or mean. When the median outcome remains above the starting level, modeled results reflect favorable expectancy under the selected assumptions.

How wide is it?

A wide distribution means results jump around a lot (higher risk). A narrow one means more predictable endings.

How much is below 0%?

Those bars show how frequently the simulation ends below the starting bankroll.

Is it skewed?

A long right tail indicates the presence of less frequent but more extreme positive generated paths.

Cross-check with other stats:

If the distribution looks nice but Max Drawdown is huge, the journey might be too painful. A different balance between simulated variability and average outcome.

The role of this value betting simulator is to help you understand the big variability you can face while using this strategy.

A betting model is capable of visualizing the possible outcomes of a sports betting scenario or strategy.

The purpose of this expectancy-based betting simulator is not to offer you a correct prediction of your future net outcomes.

Nothing can simulate this. Using the above tool helps you imagine and rationalize the risks and possible outcomes of sports betting.

Sports betting simulators allow users to explore strategies in a simulated environment, without committing real funds or experiencing real financial losses.

What is a sports betting simulator?

A sports betting simulator is an algorithm that helps users familiarize themselves with the betting process and test new strategies.

A betting simulator also helps its users to develop a better understanding of how different odds can cause losing/winning streaks.

By replicating real-time betting dynamics such as variance, they provide a practical way to build experience before placing actual bets.

In case you need a better understanding of the odds format used in the simulator (you can also change it), check this easy to use odds converter.

What are the functionalities of Sports Betting Simulators?

The main functionalities of sports betting simulators are designed to replicate multiple possible outcomes of a betting scenario/strategy.

Sports betting model allow users to review their betting history, track betting performance, and identify which strategies are working best.

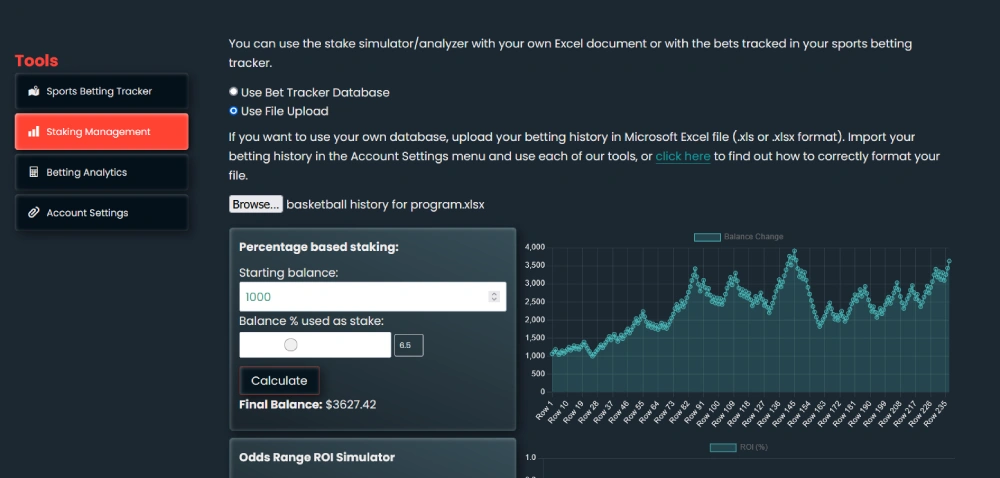

Some tools even offer tutorials and feedback to help users improve their betting techniques. Such a tool is the staking simulator developed by BetMetricsLab.

It is important to mention that the simulator and the stake management software does not take the odds closing line value of a bet into consideration.

What is a value betting simulator?

Expectancy simulation models focus specifically on value betting—a strategy that involves identifying odds that are higher than they should be based on statistics.

A value betting model is designed to illustrate outcome dispersion and uncertainty in probability-based betting models. It also visualizes fluctuations, drawdowns, and a wide range of potential generated outcomes over time.

The model will display higher simulated outcome ranges when higher theoretical expectancy assumptions are used.

The main goal of such toolss is to help bettors understand that even the best strategies can end up in a loss for a short period.

Components of the software

1. Number of bets

The modeled scenario of a expectancy-based betting activity offers a more accurate and better-visualized graph when the number of bets is high.

Outcome dispersion in expectancy-based betting can have a major influence even when the number of bets placed is significant, such as 500.

Larger sample sizes tend to provide more stable visualizations of dispersion effects.

2. Average odds and stakes

The stakes you use will not affect the trendline of your value betting modeled scenario. However, changing the average odds will have a direct effect on how variance can influence your long-term returns.

Higher quoted prices generally increase outcome variability and drawdown potential.

3. Expected Value

Expected Value represents a theoretical average outcome per bet under repeated trials, based on probability assumptions.

This percentage represents a theoretical average outcome over a large number of simulated bets.

In the model above, the expected value is input by you and it represents the net return you expect to make on your bets.

This value is used to calculate the true possibility of the outcome, which is then used to simulate the betting balance.

Please note that while calculating expected value of odds can provide an estimate of potential betting outcomes, it is based on averages and probabilities, so variance and fluctuations will modify the results.

4. More simulations

Because of the effect of outcome dispersion in expectancy-based betting, the model above performs 5 simulations for each set of input data.

This visualization helps illustrate possible trends, variability, and dispersion under different simulation assumptions.

Please note that probability-based modeled scenario have the main role of predicting possible scenarios only.

In real-world betting, outcomes may differ significantly from simulations due to market changes, pricing efficiency, and execution factors.