CLV Sports Betting Calculator

Closing Line Value measures how the odds at which a bet was placed compare to the final quoted prices offered immediately before an event begins.

CLV is commonly used as a descriptive performance metric by bettors and analysts who want to evaluate how their price selection compares to broader market movement over time. It does not evaluate whether a single bet will win or lose.

Understanding and calculating it can help with post-analysis, record-keeping, and decision review, but it does not predict future outcomes or ensure profitability on its own.

Closing Line Value Calculator

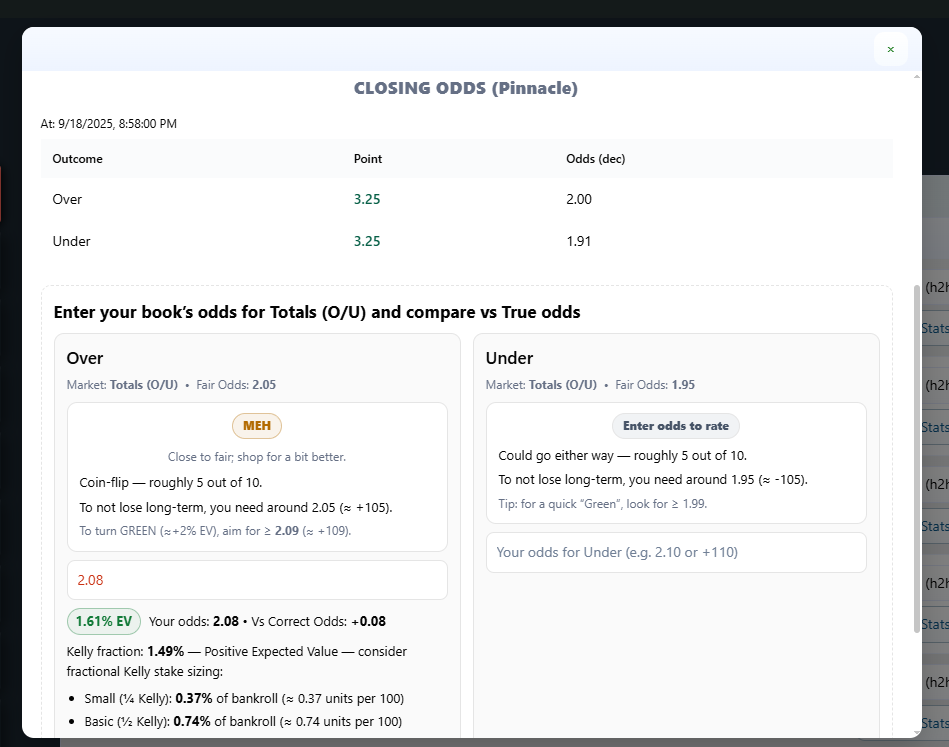

For a more consistent closing-price comparison calculation, decimal odds and no-vig (de-margined) final market prices are typically used.

You can also use the Closing Odds Request tool, which allows users to request and record final market prices for a selected match or market. Once the event starts, the recorded closing quoted prices can be used to derive it. This process is intended for tracking and analysis, not for forecasting results.

⚠️ Important Legal & Risk Disclosure

This page is for educational and analytical purposes only.

Betting laws and availability vary by jurisdiction.

Tools shown here do not guarantee outcomes or financial results.

What Does CLV Mean in Betting?

Closing Line Value reflects how the odds used when placing a bet compare to the final market odds available just before the event begins.

A CLV figure does not indicate whether a bet was correct, only whether the price taken was higher or lower than the market consensus at closing.

How Do You Calculate CLV in Betting with a Formula?

Calculating it involves comparing two key variables:

- The odds at which you placed your bet.

- The final market prices (at game time).

The formula for deriving the metric is crucial for understanding the value of your bets. For this you can also use the following EV calculator.

In its simplest form:

CLV = ((Decimal at Bet – Decimal Closing) ÷ Decimal Closing) × 100

What is the meaning of a closing-price comparison calculation in betting?

- A positive CLV indicates that the odds taken were higher than the closing odds, suggesting the market later priced the outcome as more likely.

- A negative CLV indicates the quoted prices taken were lower than the closing odds, meaning the market moved against the original price.

Tracking it over a large sample of bets can help evaluate pricing tendencies, but it does not guarantee long-term profitability, nor does it prevent losing streaks or variance.

Importantly, it does not account for bet timing, liquidity constraints, or execution issues, which can materially affect real-world results.

Example for calculating the CLV of your bets:

- You place a bet at odds of 2.50 (decimal).

- The closing odds are 2.00.

CLV = (2.50 – 2.00) ÷ 2.00 × 100 = 25%

This indicates that the bet was placed at a higher price than the final market odds. However, this does not imply the bet was financially favorable or that similar bets will be profitable in the future.

Using market-average closing odds is common, but it is not always precise. This metrics accuracy depends heavily on which bookmakers are used, how margins are removed, and market liquidity.

CLV Betting Calculator

Such calculator automates the process of calculating it for each bet. Enter the quoted prices of your bet and the closing odds for it, and the calculator will instantly display your percentage.

Benefits of using a calculator include:

- Saving time when analyzing multiple bets.

- Identifying trends in your betting performance.

- Helping you spot major mistakes in your strategies.

These tools are intended for performance review and learning, not as a standalone method for achieving profits.

Advantages of CLV

PPotential Uses

- Helps assess whether bets were consistently placed above or below market closing prices

- Supports structured record-keeping and strategy review

- Can complement other analytical approaches, such as price comparison against sharp markets

Important Limitations

- Markets can move for reasons unrelated to “true” probability

- A favorable price movement does not ensure winning bets

- Negative price-movement metric does not automatically mean poor decision-making

- Price-movement metric does not account for bankroll management, variance, or psychological factors

Relation Between CLV and Value Betting (+EV)

This metric and value betting are closely related concepts that reinforce each other in sports betting strategies. Here’s how they connect:

1. Comparison of definitions

- CLV: Measures how your bet odds compare to the final market prices, indicating whether your bet had value relative to the betting market’s final prices before the start of the event.

- Value Betting: Involves placing bets where the odds imply a lower probability of an outcome than the market average or the pricing from sharp bookmakers. This offers a positive expected value (+EV).

Both this metric and value betting (+EV) focus on identifying opportunities where the bettor has an edge over the bookmaker or market.

2. A favorable price movement Indicates Value

Positive price-movement metric is a strong sign that your bets truly hold value because the market lowered the odds since you placed them. A small price movement can count as a value bet with a positive CLV. But bettors need significant odds movements until final market prices/lines to achieve a higher positive expected value and overtime profits.

- Example: If you bet at odds of 2.50, and the closing odds are 2.00, the market determined the outcome was more likely than initially priced. This aligns with the core principle of value betting: finding and exploiting wrong/overpriced odds.

3. CLV as a Benchmark for Value Betting Success

Tracking it over time helps you evaluate the effectiveness of your value betting strategy. Although it can give you a good starting point, tracking it is not necessary for long-term success in betting.

For value bettors, maintaining a positive CLV is a great method to confirm that their bets exploit value. However, there are other methods that are more suitable for defining if a bet has value.

Comparing your betting odds to sharp bookmaker odds is a better method to define value than comparing to CLV.

4. Risk Implications

It requires waiting until close to event start to confirm market movement. As a result:

- The true value of a bet cannot be fully known at placement time

- Market movement may be influenced by liquidity, news, or timing effects

- Early positive price-movement metric does not protect against losses

For this reason, CLV should be treated as a retrospective analytical metric, not a predictive one.

Is it necessary to check the closing-price comparison of every bet?

No. Tracking it is optional and context-dependent.

Some bettors use it as part of a broader analytical process, while others rely on different evaluation methods. CLV alone is not required for long-term betting activity, nor is it a prerequisite for disciplined decision-making.

odds