Arbitrage betting between Exchanges & Sharp Bookies

AArbitrage betting that involves exchanges and sharp bookmakers such as Pinnacle is often discussed among advanced bettors, especially those who have already experienced stake limitations at traditional sportsbooks.

Some bettors also explore the possibility of arbitrage betting between betting agents and exchanges as a theoretical extension of sure betting strategies.

This article summarizes my experience, observations, and research regarding these forms of arbitrage betting, with a focus on practical limitations and real-world constraints rather than theoretical profitability.

Arbitrage Between Exchanges and Sharp Bookmakers

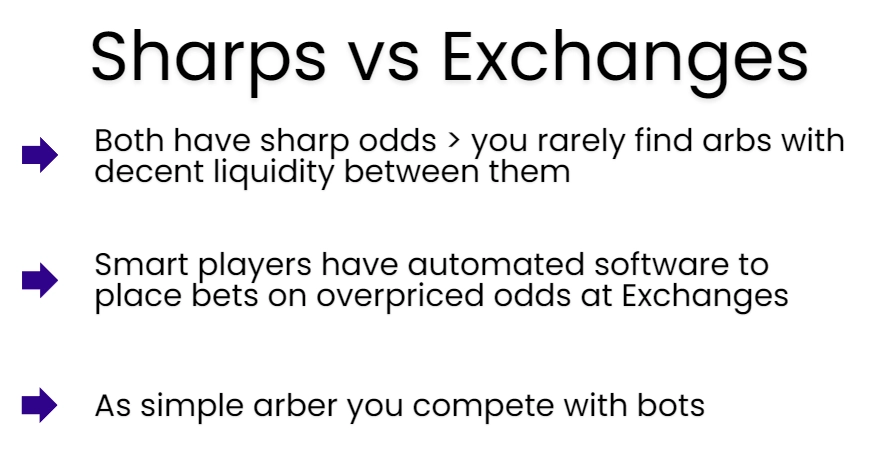

Arbitrage betting between sharp bookmakers like Pinnacle and betting exchanges is generally impractical for most regular bettors.

To understand why, it is important to examine the underlying requirements and market conditions.

What Does It Require to Attempt Arbitrage Betting?

In simple terms, arbitrage betting requires placing bets on all relevant outcomes with accurately calculated stakes before odds change.

In practice, this means acting faster than competing market participants while managing execution risk.

At present, this can only be approached either by developing strong manual market-reading skills or by using advanced arbitrage detection tools, both of which involve steep learning curves and operational limitations.

Characteristics of Sharp Bookmakers in Arbitrage Contexts

Sharp bookmakers tend to offer highly efficient odds that adjust quickly to new information.

They are known for tolerating informed betting behavior more than recreational-focused sportsbooks.

These characteristics result in competitive odds but also significantly reduce the frequency and duration of exploitable pricing discrepancies.

Relevant article: In-depth intro to arbitrage betting.

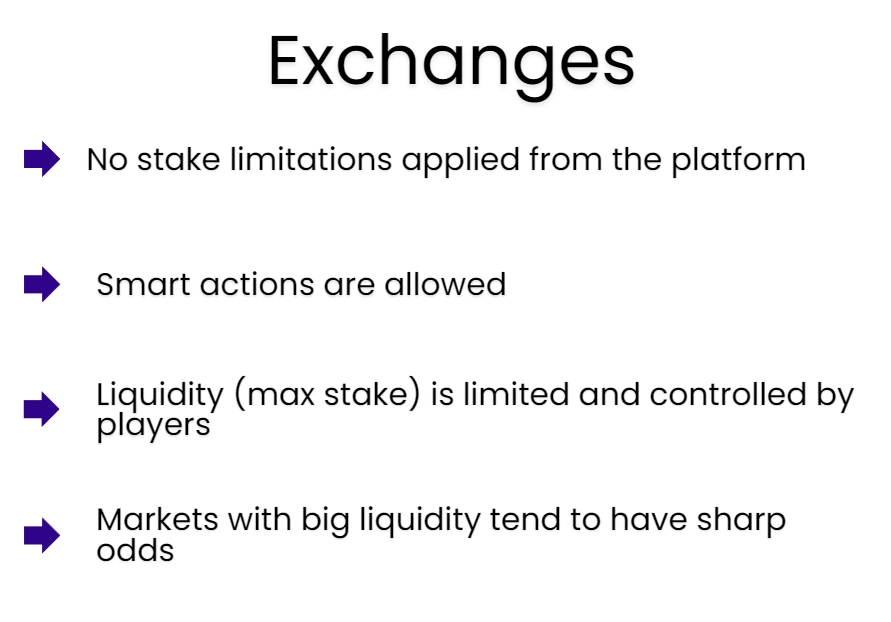

Characteristics of Betting Exchanges

Betting exchanges are heavily used by experienced bettors and traders.

They function differently from traditional sportsbooks by allowing users to bet against each other rather than against a fixed bookmaker price.

Because of this structure, exchanges tend to reflect market consensus rapidly, especially in liquid markets.

They are frequently used by matched bettors, arbitrage bettors, and sports traders, alongside a smaller proportion of recreational users.

As a result, even minor pricing inefficiencies are typically corrected within seconds.

Important Realities About Arbitrage Between Sharps and Exchanges

Is this realistically achievable?

For most bettors, the practical answer is no. Arbitrage between sharp bookmakers and exchanges is not reliably accessible.

- Odds adjust extremely quickly on both platforms.

- Bet acceptance delays at sharp bookmakers, particularly during live betting, increase execution risk.

- Available arbitrage margins are typically very small, requiring large bankrolls to generate meaningful returns.

- A single execution error can offset gains accumulated over multiple successful bets.

- Automated systems operated by professional participants often absorb available liquidity before manual bettors can react.

- Relevant article: value betting at exchanges

- Even in a hypothetical scenario without automated competition, widespread use of the same tools would rapidly eliminate any pricing discrepancies due to market pressure.

- Occasionally visible arbitrage opportunities on exchanges tend to involve low liquidity, limiting their practical usefulness.

- Even when rare opportunities are successfully executed, the financial impact is generally modest.

- Why would you waste 10-13 hours a day on these opportunities when you could simply take the most basic job and earn 5 times more?

- Matchbook (an important exchange) follows the odds of Pinnacle, but even if you notice some sure bets, they will ban you (so I would not even call them a betting exchange because of this fact).

- You would need a betting exchange account with a very low commission rate of 2% which is rare.

Comparing this effort to alternative uses of time often highlights the unfavorable risk-to-reward tradeoff.

Some platforms, such as Matchbook, closely mirror Pinnacle’s pricing and may restrict accounts that repeatedly exploit short-lived discrepancies.

Additionally, exchange commission rates further reduce net returns, particularly when margins are already thin.

In summary, arbitrage betting between sharp bookmakers and exchanges is not a viable or scalable approach for most bettors.

Even with programming skills, competing with established automated systems presents substantial technical and financial barriers.

You can also check the article on odds comparison sites/aggregators.

Arbitrage Between Betting Brokers and Exchanges

The situation differs slightly when considering betting brokers that aggregate odds from multiple sharp and Asian bookmakers.

These platforms may occasionally display temporary discrepancies due to differences in update timing across sources.

In theory, this could create arbitrage situations involving exchanges.

However, in practice, similar constraints apply.

Successful execution would require detecting opportunities faster than both public scanners and professional automated systems.

Liquidity constraints at exchanges and rapid odds adjustments at sharp bookmakers significantly reduce feasibility.

Are Some Bettors Successful in These Markets?

There are individuals who successfully operate in exchange-based environments, often relying on proprietary tools, deep market knowledge, and extensive experience.

Such bettors are rare and typically do not rely on standard arbitrage or value betting tools.

Their approaches often involve complex data analysis, long-term observation of niche markets, and adaptive decision-making.

This level of activity requires substantial expertise, time investment, and tolerance for uncertainty.

Arbitrage Between Exchanges Only

Arbitrage betting between exchanges alone is generally impractical for manual bettors.

Liquidity can change rapidly, and competing orders often absorb available prices before execution is possible.

Even when an apparent opportunity exists, partial fills or execution errors can result in unbalanced positions and financial loss.

While exchanges do not typically restrict accounts for arbitrage behavior, the operational risks remain high.

Why Some Bettors Believe Arbitrage Between Pinnacle and Betfair Is Possible

Misinterpretations often arise from delayed odds displays, pre-login price views, or scanner delays.

In my own experience, apparent discrepancies disappeared once real-time conditions were observed while logged in.

Public arbitrage tools typically operate with inherent delays, meaning opportunities shown on screen have often already been acted upon by automated systems.

When you see a sure betting opportunity appear on your screen, an automated bot has already calculated the stakes of an arb and hit the place bet button with the maximum stakes available.

FAQ

Is exchange-to-exchange arbitrage possible?

In theory, yes. In practice, it is generally accessible only to participants using automated systems.

Is arbitrage between sharp bookmakers and exchanges possible?

Technically, yes, but it requires extremely fast, specialized software and immediate execution. For most users, these conditions are not achievable.