How Much Can You Realistically Make From Arbitrage Betting?

Important disclaimer:

Arbitrage betting does not guarantee profits, does not eliminate risk, and may lead to account limitations, voided bets, or operational losses.

All figures below are illustrative estimates, not promises of results.

Actual outcomes depend on execution quality, bookmaker rules, jurisdiction, timing, and user experience.

The amount of money a bettor may generate using arbitrage betting depends on several variables, including whether bets are placed pre-match or in-play, the size of the starting bankroll, execution speed, and bookmaker behavior.

The figures below illustrate approximate scenarios based on commonly observed arbitrage margins, not guaranteed outcomes.

- You need to insert the average profit % you earn/expect on each arbitrage bet. You get this easily when you insert 100 as a total stake in a sure bet stake calculator

- Total stake/arb: you insert the average total stake you plan to place on each sure bet.

- Arbitrage bets placed/day: the number of bets you expect to place in a sigle day, in average.

- Hit calculate.

What is the profit potential of arbitrage betting?

In theory, arbitrage betting can generate approximately 1%–5% ROI on the total amount wagered over time.

This means that for every €100 staked across arbitrage bets, the theoretical return might range between €1 and €5, before accounting for errors, voids, stake limits, or commissions.

In practice, this range varies significantly depending on bet availability, execution accuracy, odds movement, and the tools used to identify opportunities.

The profitability of pre-match arbitrage betting also depends heavily on the bettor’s country of residence, local bookmaker availability, and regulatory constraints.

For example, bettors operating from the United States may encounter different market conditions compared to bettors in many European countries, but they may also face stricter limitations or fewer regulated options.

How much profit can you make with pre-match arbitrage betting?

Under typical conditions, pre-match arbitrage betting tends to generate approximately 1%–3% ROI on total stakes.

While placing arbitrage bets in the UK may be operationally easier due to bookmaker availability, accounts are often limited more quickly, and bonus offers are typically smaller.

To sustain pre-match arbitrage activity over time, bettors often need access to a large number of bookmakers.

If direct access to many sportsbooks is not available, some bettors explore betting brokers, although this introduces additional fees, compliance considerations, and jurisdictional risks.

As a general observation, more bookmakers and larger capital increase theoretical earning potential, but they also increase exposure, scrutiny, and operational complexity.

With a starting bankroll of €15,000, some bettors reported monthly figures in the range of €5,000–€10,000 during early phases with new accounts.

Negative scenario note:

These figures typically apply only short-term and often disappear once accounts are limited, stakes reduced, or betting patterns flagged.

Because of these constraints, many experienced bettors eventually look for alternative or supplementary approaches, rather than relying on pre-match arbitrage alone.

Illustrative example: pre-match arbitrage outcomes

(€100 total stake per bet)

| Average Arb % | Nr. Of bets | Monthly Profit |

|---|---|---|

| 0.5 | 200 | 100 |

| 0.5 | 350 | 175 |

| 0.5 | 500 | 250 |

| 1 | 200 | 200 |

| 1 | 350 | 350 |

| 1 | 500 | 500 |

| 1.5 | 200 | 300 |

| 1.5 | 350 | 525 |

| 1.5 | 500 | 750 |

| 2 | 200 | 400 |

| 2 | 350 | 700 |

| 2 | 500 | 1000 |

| 2.5 | 200 | 500 |

| 2.5 | 350 | 875 |

| 2.5 | 500 | 1250 |

| 3 | 200 | 600 |

| 3 | 350 | 1050 |

| 3 | 500 | 1500 |

As shown above, using a €100 stake per arbitrage bet, theoretical monthly outcomes range from €1,000–€1,500 only if 350–500 bets are executed successfully.

Negative scenario note:

This assumes no odds changes, no voided bets, no stake limits, no account restrictions, and perfect execution — conditions that rarely persist long-term.

After gaining experience with pre-match arbitrage, some bettors experiment with in-play arbitrage, which introduces both higher potential margins and higher execution risk.

The arbitrage software or app used can significantly affect results, but free tools may miss opportunities or display delayed odds, while paid tools introduce fixed costs.

How much can you make with in-play arbitrage betting?

Under controlled conditions, a beginner in-play arbitrage bettor may generate approximately €300–€500 per month with a starting capital of €3,000–€5,000.

More experienced users sometimes report figures up to three times higher, primarily due to faster execution and better market selection, not reduced risk.

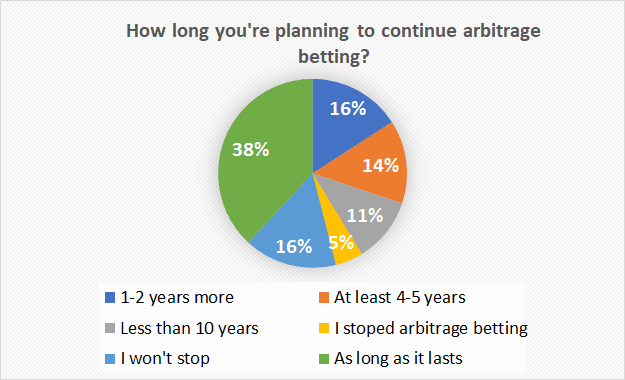

Many arbitrage bettors believe the strategy remains viable for one to two additional years, although this depends on bookmaker countermeasures and regulation.

Down below, you can see a table with possible monthly profits with live arbitrage betting.

For every bet, I used the same total stake of 100 euros as in the pre-match arbing.

| Average Arb % | Nr. Of bets | Monthly Profit |

|---|---|---|

| 1.5 | 250 | 375 |

| 1.5 | 350 | 525 |

| 1.5 | 550 | 825 |

| 2 | 250 | 500 |

| 2 | 350 | 700 |

| 2 | 550 | 1100 |

| 2.5 | 250 | 625 |

| 2.5 | 350 | 875 |

| 2.5 | 550 | 1375 |

| 3 | 250 | 750 |

| 3 | 350 | 1050 |

| 3 | 550 | 1650 |

| 3.5 | 250 | 875 |

| 3.5 | 350 | 1225 |

| 3.5 | 550 | 1925 |

Monthly outcomes from in-play arbitrage vary significantly depending on time commitment, reaction speed, and capital availability.

While average arbitrage percentages and volume tend to be higher in live betting, the risk of errors, voided bets, and immediate account action is also higher.

In-play bets settle faster, which can improve capital turnover, but mistimed clicks, suspended markets, or score delays can result in losses.

Key factors influencing arbitrage profitability

1. Economic environment of your country

The economic context of a bettor’s country can influence deposit scrutiny, stake limits, and account monitoring.

Bettors from higher-income countries such as Sweden, the UK, or Germany may face fewer immediate red flags compared to bettors from lower-income regions.

In less-developed economies, bookmakers may apply lower stake limits or request additional verification once balances increase.

For example, depositing €6,000–€8,000 rapidly in a country with an average monthly income of €200–€250 may trigger enhanced checks.

This can result in requests for proof of income, account freezes, or delayed withdrawals.

2. Number of bookmakers available

Some jurisdictions strictly regulate gambling operators, limiting the number of licensed bookmakers.

Local bookmakers often do not appear in arbitrage scanners, reducing opportunity volume.

Offshore or crypto-based bookmakers may offer opportunities but introduce additional legal and counterparty risk.

Tax treatment also varies, and bettors should verify local tax obligations before starting.

Read the following article on how to find a good arbitrage bet and figure out the best methods.

3. Size of starting capital

Many sources suggest €2,000+ as a practical minimum for meaningful arbitrage activity.

Larger capital allows faster turnover and access to higher-value opportunities, but also increases exposure and scrutiny.

It is possible to start sure betting with smaller amounts

For example, I began with €100, but it took 1–2 months of careful execution to reach a level where most opportunities were accessible.

For bettors unable to invest €2,000–€2,500, starting with €100–€200 is feasible if they are prepared for slower growth, lower margins, and higher relative risk.

Final perspective

Arbitrage betting can generate small, repeatable margins, but it is not risk-free, not scalable indefinitely, and not immune to account restrictions.

Profitability depends more on discipline, execution, and risk management than on percentages alone.

Expectations should remain conservative, and results should be evaluated over long samples, not isolated months.