Parlay Hedging Calculator & Risk-Management Guide

Parlay hedging is a risk-management technique that some bettors use to reduce exposure on accumulator bets by offsetting potential outcomes across different markets.

Some bettors choose to learn about hedging or covering individual legs of a parlay in order to better understand payout volatility, downside protection, and decision-making under uncertainty.

This article explains, in an educational and analytical context, how hedging calculations work when applied to accumulator bets, and how a calculator can model different outcomes.

Parlay arbitrage betting calculator

Parlay Builder & Hedge Inputs

Sequential hedging works best when legs are time-staggered (next game starts after the previous ends). Enter each leg’s parlay selection odds and the hedge (opposite) odds available at a second book.

Results & Planner

Quick Last-Leg Hedge

⚠️ Educational Disclaimer

This page is for educational and analytical purposes only. Hedging and arbitrage-style calculations involve financial risk, may not be permitted by all operators, and do not guarantee profits. Availability of odds, account restrictions, timing, and market changes can materially affect outcomes. Users should ensure compliance with local laws and bookmaker terms.

Guide on how to use the parlay arbitrage betting calculator

The big idea

- Parlay = one bet made of several picks (“legs”). If every leg wins, the payout is big. If one loses, the parlay loses.

- Hedge = a safety bet on the opposite side of a leg to protect yourself.

- Goal = evaluate whether placing hedge bets before individual legs begin can reduce downside risk or stabilize outcomes, depending on odds, timing, and market availability.

What you enter in the parlay calculator

- Stake: how much you’re risking on the parlay (e.g., 100).

- Odds format: Decimal (1.91), American (+120 / −110), or Fractional (10/11).

The tool converts everything. For other use cases you can use this odds converter tool. - Add legs in the order they start (earliest game first).

- For each leg:

- Parlay selection odds: the odds of the team/side you picked for your parlay.

- Hedge (opposite) odds: the odds to bet against your pick (usually at another sportsbook).

Then click Calculate plan.

What the results show

- Legs / Parlay odds / Potential Return: quick summary at the top.

- Planner table (per leg):

- Worth before leg: how much your parlay “coupon” is effectively worth at that point.

- Hedge stake: how much to bet on the opposite side before that leg starts.

- Outcome Profits:

- Shows your profit if the parlay ends at each leg (because that leg lost), or if it wins all the way.

- Green = profit, Red = loss. Aim for all green (or accept small risk).

Why the hedge amounts look weird

The calculator balances two paths at each step:

- Path A: your parlay leg wins and moves on (coupon gets bigger).

- Path B: your parlay leg loses now (hedge wins).

It sizes the hedge so those paths are as even as possible, aiming to balance potential outcomes more evenly, rather than maximizing a single result.

A tiny example

- Stake $100.

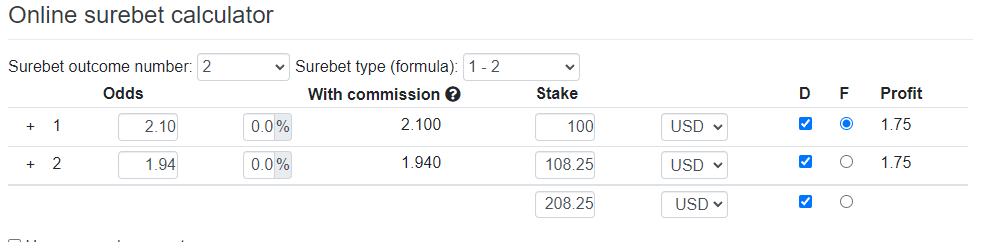

- Leg 1: Parlay odds 2.10, Hedge odds 1.94 → suggests about $108.25 on the hedge.

- If the parlay settles at this stage, the model shows a small net difference between outcomes, assuming prices remain available.

- Leg 2: Parlay odds 1.78, Hedge odds 2.33 → suggests about $160.43 on the hedge.

- If the parlay ends at leg 2 (or even wins it all), you’re about +$5.12.

Numbers shift with your odds; the tool does the math for you.

Quick Last-Leg Hedge tool (fast safety button)

Use this when only one game is left:

- Enter the Total potential return of your parlay (shown at the top).

- Enter the opposite side’s odds for the last leg.

- Pick a plan:

- Equal profit: same profit whether the parlay wins or loses.

- Protect stake: set the hedge so losing the parlay roughly breaks even.

- Custom: choose a guaranteed profit you want if the parlay loses.

- Click Compute to see the hedge stake and both outcomes.

Tips for good use

- Order legs by start time. You hedge before each game begins.

- Works best on two-way markets (Team A vs Team B, Over vs Under).

- Lines move. Re-calculate if odds change.

- The tool ignores fees/commission and pushes; reality can differ a little.

- If the calculator displays negative outcomes, it indicates that available prices do not support balanced exposure, and the scenario may not be suitable for hedging.

That’s it! Enter odds, follow the suggested hedge amounts before each leg, and you’ll see your worst-case and best-case clearly—so you can bet with a plan, not a guess.

Parlay arbitrage: How to hedge a parlay profitably

Below, you can find examples and explanations of how to hedge parlay arbitrage bets.

- Find two matches where the second match will begin after the end of the first sports event. (This is required so you can hedge your parlay depending on the result of your first leg)

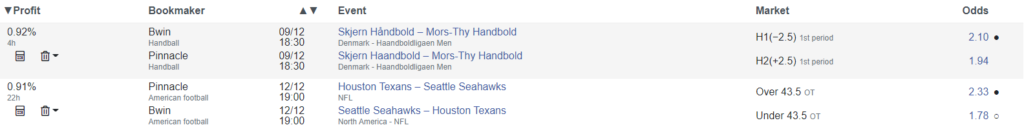

In the picture above, I found two random sports events that have arbitrage bets on them. As you see there is a decent time of 18 hours between the start of these events (you don’t need that much, I chose these matches randomly).

#1. You place a parlay bet with combining at Bwin on a single coupon:

- Skjern Handbold – Mors-Thy Handbold H1(-2.5) on odds of 2.10

- With Seattle Seahawks – Houston Texans Under 43.5 on odds of 1.78

Placing this bet with a stake of 100 euros.

This would mean a parlay of: 2.10*1.78*100€ = 373.8€

- You hedge/cover the other outcome of the first match on Pinnacle as it would be a simple arbitrage bet

- You need to use a simple arbitrage betting calculator like the one in the picture below (you can find it on this site as well).

- Hedge the first leg of your parlay by using the stake of 100 euros (you fix it as a constant stake)

- You hedge the first leg of your parlay on the odds of 1.94 with a stake of 108.2 euros at Pinnacle (right after placing the accumulator bet).

#2. The next step is depending on the outcome of the first match

1st Scenario – H2(+2.5) hedge bet wins at Pinnacle

The first leg of your parlay at Bwin is lost, and you win the Hedge at Pinnacle. You win the H2(+2.5) hedge bet with a stake of 108.2€.

Your profit: Odds of 1.94 * 108.2€ – 108.2€ – 100€ (total stake of parlay) = 1.70€ of profit

In this case, your parlay bet at Bwin is lost and you made a total profit of 1.70€ -> Task completed

2nd Scenario – H1(-2.5) first leg of parlay bet wins at Bwin

- In this case, your Pinnacle bet with 108.2€ is lost

- The first match in your parlay at Bwin is a winner, the coupon is still open with a match still unsettled

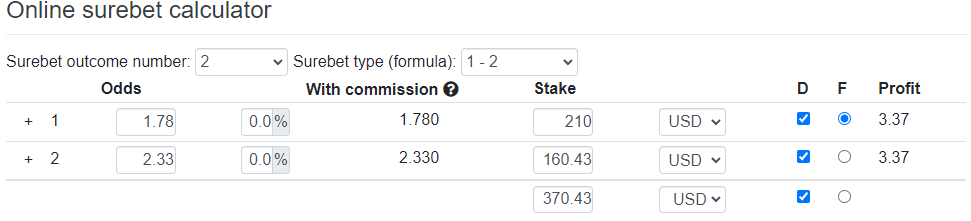

Your Parlay bet is worth: 1 winning bet Odds of 2.10 * stake of 100€= 210€

In this case, you need to cover the outcome of your last bet once again at Pinnacle.

The calculation for hedging your arb parlay is as follows:

- The odds of the second match in the parlay is 1.78 for under 43.5

- The stake is the actual worth of your parlay bet: 210€

- You hedge the bet at Pinnacle on under 43.5 on odds of 2.33 with a stake of 160.4€

Check the picture below:

Results at arbing on parlay bets

- the second leg in your parlay at Bwin wins:

- Your parlay is a winner: You win 373.8€ at Bwin – initial stake at Bwin (100€) – first leg hedge at Pinnacle (108.2€) – second leg hedge at Pinnacle (160.4€) = Total profit of 5.2€Your second hedge bet wins at Pinnacle:

- 2.33 Odds * 160.4€ = 373.7€ winnings

- From this winning, you have to deduct: 100€ initial stake of parlay, first leg hedge stake at Pinnacle (108.2€), and second leg hedge stake at Pinnacle (160.4€)

- The total profit in this case is: 373.7€ – 100€ – 108.2€ – 160.4€ = 5.1€

I have several other articles about sure betting, one of the most recent for both beginner and more experienced levels is the one about tips for successful arbitrage betting.

What does it mean to hedge a parlay bet?

Hedging a parlay bet means you are covering the other outcomes of your initial bet. For hedging a parlay bet you need to use a different betting site.

The most common use is when you have a parlay bet with 3-4-6 matches in it and 2-3-5 are winners and the bettor wants to secure a guaranteed win by covering/hedging the other outcome of the last match.

Parlay bets, or by another name, accumulators bets, are the most popular betting type among average punters.

The majority of simple bettors are trying to take advantage of cumulative odds and higher returns with a smaller stake.

In most cases, this attempt fails and will lead to a loss in the long term.

But there are cases when the bettor wants to take a guaranteed profit from a parlay bet by covering/hedging the last leg of it.

In some situations, hedging may allow bettors to reduce variance or preserve part of an unrealized return, though outcomes are never guaranteed and depend on market conditions.

Should you hedge the last leg of a parlay?

Hedging the final leg is a personal risk-management decision. Some bettors choose to hedge to reduce uncertainty, while others accept full variance for a higher potential payout.

You should not hedge the last leg of a parlay bet when you want to take risks for a higher payout.

This article focuses on illustrating how hedging calculations work, not on guaranteeing outcomes or long-term results. So, hedging the last leg of a parlay bet is a smart decision in many cases.

I don’t like parlay bets in general, because they decrease the chance of winning, even in the long run. A small exception is accumulator bets with overpriced odds.

But if you were lucky enough to win 5 of 6 legs of your parlay bet, it would be a smart decision to harvest your guaranteed profits by hedging the last leg.

Can you arbitrage on parlay bets?

Yes, you can place arbitrage bets on parlays to make guaranteed profits by hedging each outcome.

Bookmakers are taking parlay bets as a direct sign of being a bettor who loses in the long run. Some bettors prefer accumulator-based approaches because they behave differently from single-market bets, though account treatment varies by operator and is outside the scope of this guide.

As an arbitrage or matched bettor, getting your accounts limited or gubbed is the most common reason why you can’t succeed in the long run.

Identifying pricing discrepancies does not guarantee profits, as execution, timing, and bookmaker policies can materially affect results. This betting activity is not welcomed by the majority of bookies.

Parlay bets can be a fairly good alternative and tool for making the bookie algorithms think that you are an average bettor.

Some experienced bettors report mixed results when applying hedging or pricing models to accumulator bets, highlighting the importance of experience, discipline, and realistic expectations.

Difference between arbitrage betting and parlay arbitrage:

- While arbing with single bets you will get limited way faster

- Arbing with parlay bets requires more attention and time investment

How do you hedge a parlay bet?

Arbitrage betting on parlay bets/accumulators is not simple. It can highly reduce the chances of getting caught, but it requires a lot of time investment.

While using arbitrage betting finder with simple single bets, you cover both outcomes, and you are done with that arb. With parlay bets, it is way more complicated.

Conclusion

As you can see using accumulator bets for arbitrage betting requires more calculation and input of energy. Hedging accumulator bets requires careful calculation, availability of opposing markets, and acceptance of residual risk. This calculator is designed to help users understand possible outcomes, not to predict or promise profitability.