Prediction Market Arbitrage Betting

Arbitrage betting on prediction markets can be viewed as an alternative application of price-discrepancy analysis when compared to traditional sports arbitrage.

Many individuals who have experimented with sports arbitrage have experienced account restrictions or limitations imposed by sportsbooks.

Prediction markets present a structurally different environment that can allow price differences to exist, although they also introduce specific operational, liquidity, and regulatory considerations.

This article explores how these platforms work, what types of discrepancies can occur, and the practical limitations involved.

Example of price discrepancies on prediction markets

At present, pricing differences on prediction markets can be identified by manually comparing implied probabilities across platforms.

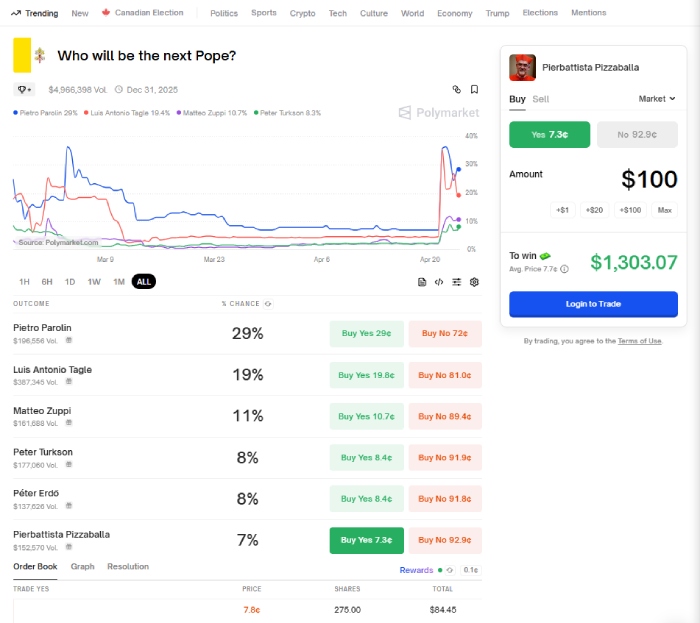

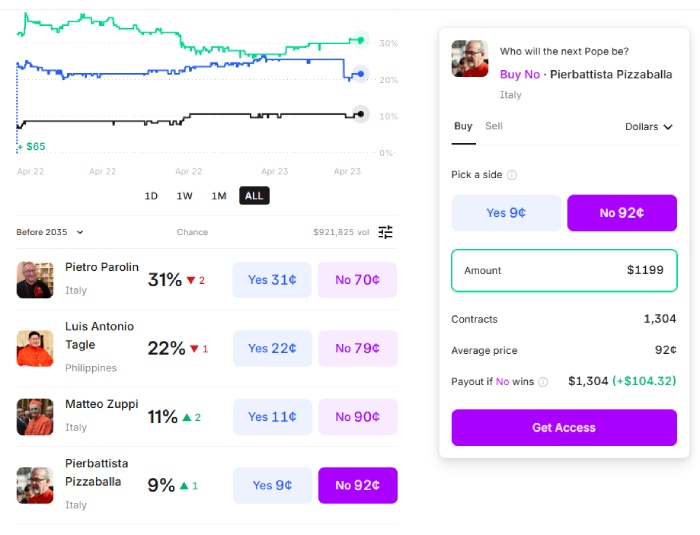

For example, while reviewing a high-interest political market, a noticeable difference in implied probability appeared between platforms.

A practical method for identifying potential discrepancies is to compare the percentage chance assigned to the same outcome across multiple venues.

In one instance involving Pierbattista Pizzaballa, the observed difference was approximately 2%, which suggested that prices were not fully aligned.

On Polymarket, the price for this outcome was listed at 7.3, while on Kalshi, the opposing position was priced at 92.

When converted into a consistent decimal-odds format, these prices represented materially different implied probabilities.

It is important to note that identifying such discrepancies does not automatically imply usability at scale, as liquidity and execution constraints apply.

Converting prices and calculating exposure

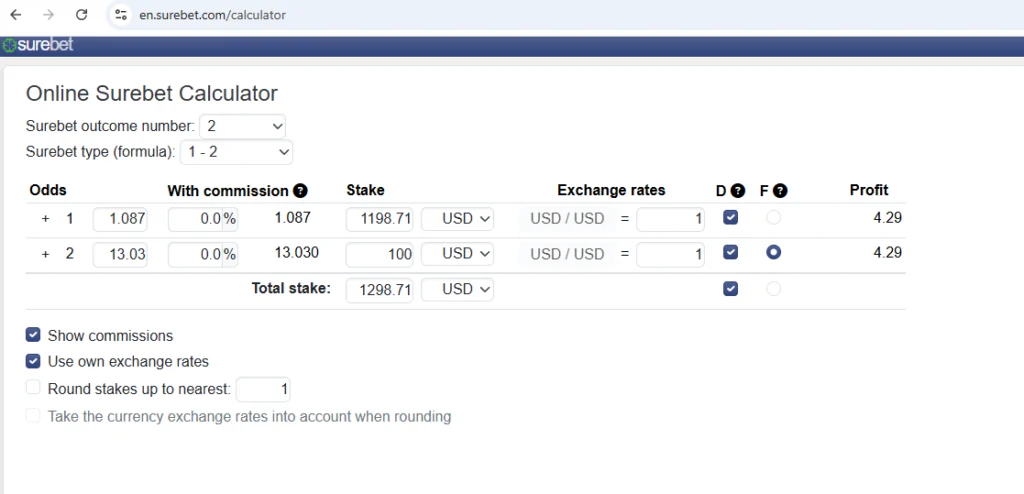

With prior experience in traditional arbitrage betting, a dedicated prediction-market calculator was not strictly necessary.

Instead, a standard arbitrage calculator was used to convert prediction-market prices into decimal-odds equivalents.

A price of 7.3 corresponded to approximately 13.03 in decimal odds, while a price of 92 translated to roughly 1.087.

The next step involved determining stake sizes that would equalize exposure across outcomes, accounting for platform-specific pricing conventions.

This process aims to balance outcome exposure rather than ensure any particular financial result.

I fired up the arb stake calculator of surebet.com and checked the odds at the platforms. By inserting a stake of 10 or 100, you can see the decimal odds format of prices from the prediction market.

How discrepancies may appear between prediction markets

At the time of publication, automated arbitrage-scanning tools for prediction markets remain limited, making manual comparison the primary approach.

To identify potential discrepancies, users typically need to open two or more platforms simultaneously and compare prices for identical markets.

Larger differences in implied probability increase the likelihood of price inefficiencies, although they do not guarantee executable opportunities.

Similar to betting exchanges, each outcome may offer multiple price levels with varying liquidity.

In many cases, the available liquidity at favorable prices may be very small.

As a result, even when price differences exist, the practical exposure achievable may be minimal.

Attempting to increase position size often leads to worse prices, which can eliminate the discrepancy entirely.

In some cases, price slippage can result in an unfavorable position rather than a neutral one.

Observed characteristics of prediction-market arbitrage

Prediction markets such as Polymarket and Kalshi do not currently restrict users specifically for exploiting price differences.

Because many markets are event-driven and less standardized than sports markets, prices may diverge more frequently.

One notable difference compared to sportsbooks is the generally higher maximum position sizes available on certain high-profile markets.

For example, during the 2024 U.S. presidential election cycle, some markets displayed large price gaps between platforms.

While percentage differences were often smaller than those seen in sports arbitrage, higher liquidity allowed larger nominal exposure.

In practice, discrepancies in the range of approximately 1%–2.5% were observed, subject to execution constraints.

Risks and limitations of prediction-market arbitrage

A key limitation of this approach is the lack of dedicated automation, requiring continuous manual monitoring and calculation.

This makes the process time-intensive and less scalable than traditional sports arbitrage using automated tools.

As prediction-market infrastructure matures, increased efficiency is likely to reduce the frequency and duration of pricing differences.

One of the most significant risks arises from differences in market-resolution rules between platforms.

For example, in election markets where more than two outcomes may exist, changes such as candidate withdrawals can affect settlement conditions.

In such scenarios, it is possible for both positions to be settled unfavorably due to differing resolution criteria.

These structural risks must be evaluated carefully before attempting to balance exposure across platforms.

Platform tolerance toward price-difference strategies

At present, prediction markets function similarly to betting exchanges in that they are generally tolerant of users who trade price differences.

However, platform rules, fee structures, and dispute mechanisms vary and should be reviewed individually.

Major prediction-market platforms

Currently, three prediction markets offer sufficient liquidity and operational stability for comparative analysis: Polymarket, PredictIt, and Kalshi.

A detailed platform comparison is available separately: PolyMarket vs Kalshi.

Polymarket

Fees and structure:

No trading fees are charged.

No withdrawal fees apply when cashing out USDC.

The platform operates on Polygon, resulting in low network transaction costs.

Operational considerations:

Polymarket operates in a regulatory gray area, which introduces legal and operational uncertainty.

User experience:

The platform is decentralized and crypto-based, requiring USDC for participation.

It offers a wide range of markets, including niche and trend-driven events.

Liquidity is generally high for popular topics.

PredictIt

Fees and structure:

A 10% fee applies to profitable trades.

A 5% fee applies to withdrawals.

These fees significantly affect net outcomes, particularly for high-frequency activity.

Regulatory status:

PredictIt operates under a specific regulatory framework, primarily for political markets.

Past legal challenges have influenced platform operations.

User experience:

Uses fiat currency, making it accessible to non-crypto users.

Market variety is limited compared to decentralized platforms.

Kalshi

Fees:

Deposit and withdrawal fees vary by payment method, including a 2% debit-card fee.

Trading fees:

Fees apply primarily to immediately matched orders.

Maker fees apply to certain resting orders, with detailed formulas provided by the platform.

Regulatory status:

Kalshi is regulated by the CFTC, offering a higher level of legal clarity.

User experience:

Uses fiat currency and provides a more traditional interface.

Market selection is narrower than Polymarket’s.

Prediction markets vs betting exchanges

Long-term users often note that prediction markets operate differently from traditional betting exchanges.

On exchanges such as Betfair, fees on winnings can significantly reduce net outcomes unless pricing skill is consistently strong.

Prediction markets with lower fee structures can reduce transaction costs, but they introduce other uncertainties such as rule interpretation.

Liquidity, dispute resolution, and long-term platform incentives differ substantially from sportsbook or exchange models.

Final perspective

Prediction-market arbitrage should be viewed as a niche analytical activity rather than a repeatable or guaranteed strategy.

Pricing differences exist, but execution risk, liquidity constraints, and rule inconsistencies play a significant role.

As platforms evolve, inefficiencies are likely to diminish.

Anyone exploring this area should approach it as an educational exercise in market structure and probability pricing rather than a dependable outcome-driven method. with sharp books like Pinnacle. Polymarket’s no-fee model and tight spreads usually offer the best odds, so there’s a lot of action.