Polymarket vs Kalshi: Structural, Regulatory, and Feature Comparison

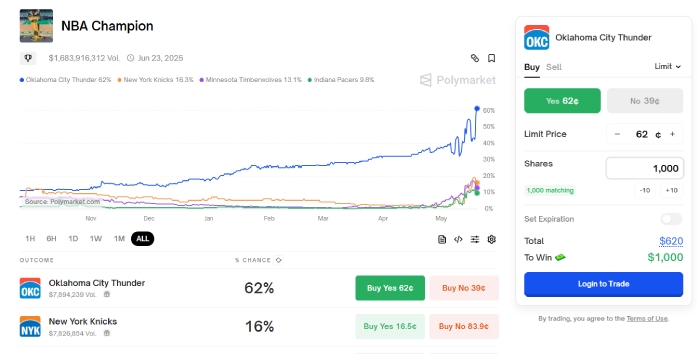

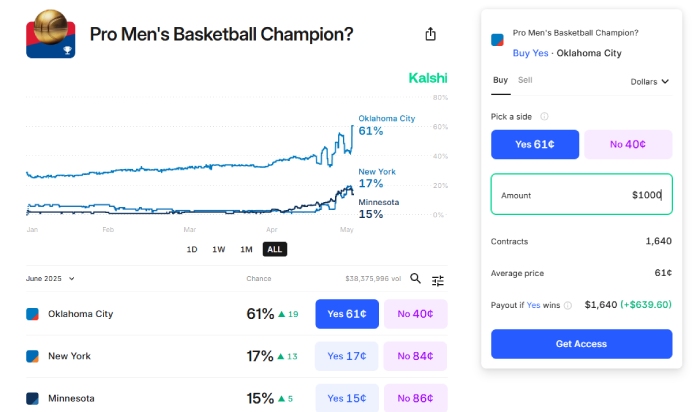

Polymarket and Kalshi are well-known prediction market platforms with established user communities.

The main difference you will find between these platforms is the fee structures they use and the countries/jurisdictions they restrict and allow.

Jump to the comparison overview

What is Polymarket?

Polymarket is a decentralized prediction market platform built on blockchain technology that allows users to trade/bet on the outcomes of real-world events.

The platform offers event-based markets covering areas such as politics, sports, cryptocurrency, finance, and other public-interest topics.

Polymarket runs on the Polygon network for fast, low-cost transactions and leverages USDC as its primary currency.

What is Kalshi?

Kalshi is a CFTC-regulated event-based trading platform where users can buy “Yes” or “No” contracts on the outcomes of future events.

Similarly to Polymarket, these events can be from economic indicators and political developments to weather and business trends.

At the moment, Kalshi operates within the traditional U.S. financial regulatory framework, allowing participation only from users located in the United States.

Comparison table of Polymarket vs Kalshi

| Feature | Polymarket | Kalshi |

| Platform Type | Decentralized prediction market on Polygon blockchain | CFTC-regulated event contract exchange |

| Regulatory Status | Operates outside traditional financial regulation, with geographic restrictions applied in certain regions | Fully regulated by the U.S. Commodity Futures Trading Commission (CFTC) |

| Trading Mechanism | Peer-to-peer trading of outcome shares | Centralized exchange matching buyers and sellers |

| Currency Used | USDC (stablecoin) | USD |

| Trading Fees | No trading fees for buying/selling outcome shares | More info below |

| Profit Fees | 2% fee on net profits from winning trades | More info below |

| Deposit/Withdrawal Fees | No fees from Polymarket; however, network (gas) fees apply | 2% for Debit card payments |

| Settlement Fees | None | 10% fee on net winnings upon contract settlement |

| Market Topics | Politics, crypto, sports, current events | Politics, economics, weather, business, and more |

| User Access | Restricted in many countries, more info below | Decentralized prediction market on the Polygon blockchain |

| Mobile Access | Web-based interface; no dedicated mobile app | Web-based interface; no dedicated mobile app |

| VPN usage | Not allowed | Not mentioned |

| Know Your Customer verification | Yes | Yes |

| US players allowed | No | Yes |

If you are interested in the mechanics of price discrepancies in prediction markets, you can explore our educational article on prediction market arbitrage concepts.

Polymarket Odds & Fees

- No trading fees are charged.

- Charges no withdrawal fee when cashing out USDC.

- Built on Polygon: minimal network transaction fees.

- Often noted for its relatively low direct platform fees compared to similar services.

Reliability:

- Operates in a regulatory gray area.

- The lack of formal financial regulation introduces regulatory and legal uncertainties that users should carefully consider.

User Experience:

- Decentralized and blockchain-based.

- Uses USDC (crypto) for transactions, which may be a barrier for some.

- Offers a very broad and dynamic range of markets, including niche and humorous events.

- Capitalizes on social media trends to create betting events.

- High-volume and real-time data-driven.

Kalshi Odds & Fees

- Deposit/withdrawal fees vary by payment method: a 2% fee for debit cards for both deposits and withdrawals.

- A structured fee model that varies depending on order type and payment method.

1. Trading Fees (for all markets except certain listed ones):

- Charged only when an order is immediately matched (i.e., it takes liquidity).

- Not charged for unmatched orders that remain on the order book (unless part of Maker Fees).

- Formula:

fees = round up(0.07 × C × P × (1 – P))- C = number of contracts

- P = contract price in dollars (e.g., 50¢ = 0.5)

- round up = rounds to the next cent

Example:

- Buy 10 contracts at 0.60 (60¢):

fees = round up(0.07 × 10 × 0.6 × 0.4) = round up(0.168) = $0.17

2. Maker Fees (only for certain products listed by ticker):

- Charged for resting orders that are not immediately matched but later executed.

- Formula:

fees = round up(0.0025 × C) - No fee if the order is placed but canceled before being matched.

Example:

- Place 5 resting contracts that get filled:

fees = round up(0.0025 × 5) = round up(0.0125) = $0.02

3. Rebates for Rounding:

- If rounding causes the total fee to exceed the actual rate by more than $10/month, the excess is reimbursed the next month.

Rebate Example:

- Place 5 orders × 5 contracts = 25 total contracts

- Actual fee: 25 × $0.0025 = $0.0625

- Charged due to rounding: 5 × round up(5 × $0.0025) = 5 × $0.02 = $0.10

- Rebate = $0.10 – $0.0625 = $0.0375, rounded up to $0.04

Reliability:

- Fully regulated by the CFTC (Commodity Futures Trading Commission).

- Provides strong legal assurance and reliability.

User Experience:

- Uses fiat currency, appealing to more traditional users.

- User-friendly interface.

- More limited market selection compared to Polymarket.

Countries restricted by Polymarket

Polymarket restricts access in several jurisdictions, including the United States and other regions subject to regulatory or compliance limitations.

Countries restricted by Kalshi

At the moment, Kalshi allows only US users to place bets/predictions. They do have a waitlist for international users in case they open the gates after the regulatory approval gets a green light.

Key features comparison of Kalshi vs Polymarket

After spending significant time analyzing both Polymarket and Kalshi, After extended analysis, clear structural and regulatory differences between these two platforms become apparent.

While both offer “Yes/No” contracts priced between $0 and $1, their underlying philosophies, user experiences, and use cases vary widely. Below is a breakdown based on direct experience:

1. Regulation & Compliance

- Kalshi: As the only CFTC-regulated prediction market in the U.S., Kalshi provides peace of mind with full legal clarity. Setting up an account feels like opening one with a traditional brokerage, complete with KYC and funding via ACH or debit card. This structure may appeal to U.S.-based users who prioritize regulatory clarity.

- Polymarket: In contrast, Polymarket operates in a decentralized, non-custodial environment on the Polygon blockchain. There’s no KYC, no account setup hurdles, users connect a compatible cryptocurrency wallet to access markets, subject to jurisdictional restrictions. While this offers global accessibility and privacy, it’s also not available to U.S. users due to regulatory restrictions.

Verdict:

Kalshi emphasizes regulatory compliance, while Polymarket focuses on decentralized, permissionless market access, each serving different user preferences.

2. Funding and Currency

- Kalshi: Trades are conducted in USD, and funding your account via traditional banking methods is straightforward. More accessible for users who prefer traditional fiat-based systems.

- Polymarket: Uses USDC, a stablecoin pegged to the U.S. dollar. Crypto-savvy users will appreciate the seamless wallet-based experience, but newcomers might face a learning curve.

Verdict:

Kalshi is easier for fiat users; Polymarket is better suited for crypto natives.

3. Market Topics and Breadth

- Polymarket: Truly global and current. The platform offers a wide range of markets, from cryptocurrency pricing to geopolitical and culturally driven events. The community frequently suggests new markets, so the range is always timely and dynamic.

- Kalshi: Offers structured markets focused on U.S.-centric themes, elections, economic data, weather events, etc. It’s a great fit for those interested in more “serious” or institutional-level forecasting.

Verdict:

Polymarket offers broader and more reactive topics; Kalshi is more traditional and finance-focused.

4. Trading Experience

- Kalshi: The interface is clean and easy to navigate. Placing trades feels like using a stock trading app. Market depth is often high, thanks to institutional market makers like SIG. Fees are transparent, and order execution is reliable.

- Polymarket: Fast and cheap trades thanks to the Polygon blockchain. The platform is designed for fast execution with relatively low transaction costs due to its blockchain infrastructure.That said, UX can be intimidating for non-crypto users, and gas fees (while low) still apply if you’re bridging funds.

Verdict:

Kalshi shines in simplicity and polish; Polymarket excels in speed and low-cost execution.

5. Hedging and Use Cases

- Kalshi: Beyond speculation,Some users view Kalshi’s event contracts as informational tools that reflect market expectations around economic indicators such as inflation or interest rates. It’s clear the platform is aiming to become a serious financial tool.

- Polymarket: While Polymarket is more geared toward retail forecasting and informational markets, its open-ended nature means it captures events no other platform dares to list. It’s less about hedging, more about insight and rapid sentiment detection.

Verdict:

Kalshi is great for financial hedging; Polymarket thrives on community-driven information markets.

6. Community and Censorship Resistance

- Polymarket: A notable feature of Polymarket is its decentralized design, which reduces centralized control over market listings. Markets are shaped by the community, not gatekeepers. Data is publicly accessible, which has led to its use as a reference source for market sentiment analysis by various observers.

- Kalshi: Operates within regulatory constraints, meaning some markets, especially controversial ones, might not be listed due to compliance concerns.

Verdict:

Polymarket leads in openness and censorship resistance; Kalshi provides regulatory security but with topic limitations.