Kelly Criterion: Stake Calculator, Definition, Formula

Bankroll % to wager:

Stake to wager:

The objective of the Kelly Criterion is to provide a mathematical framework for capital allocation based on risk tolerance, available funds, betting odds, and estimated outcome probability.

The Kelly method approach is designed to help manage exposure during losing streaks and structure exposure levels based on probabilistic assumptions over long sequences of bets.

Important to notice: while this bankroll allocation approach sounds great, the truth behind it is that you will struggle to apply it on each of the bets you place.

⚠️ Important Legal & Risk Disclosure

This page is for educational and analytical purposes only.

Betting laws and availability vary by jurisdiction.

Tools shown here do not guarantee outcomes or financial results.

How does this Kelly Criterion Calculator work?

The majority of Kelly’s criterion wager amount calculators on the market ask you to insert four types of data:

- Your actual betting account balance

- The odds you want to place a bet on

- Probability of winning in %

- The fraction of Kelly you want to use

This approach to calculating the right stakes might seem the simplest until you need to insert the true statistical probability of the betting outcome you chose.

To have the correct wager amount with the Kelly criterion calculation, the true statistical probability of the outcome is necessary under the model.

The odds you want to place a bet on are hopefully overpriced, so calculating the probability from that is impractical.

This is why I developed a new approach, the Kelly criterion stake calculator, that allows you to easily find out the statistical probability.

How is this performed?

- You find the same betting market at sharp/accurate sportsbooks such as Pinnacle

- Insert these sharp odds in the right fields (sharp odds same & other outcome)

Definition of Kelly Criterion staking in sports betting

The Kelly method is a mathematical formula that can be applied in sports betting to help bettors calculate the most optimal stakes. This formula was initially developed by J.L. Kelly in 1956.

The original goal of this formula was to maximize theoretical growth by optimizing financial portfolios. Fortunately, later bettors started using the formula to achieve a more effective stake-sizing strategy.

The Kelly Criterion money management method is commonly referenced for illustrating how exposure level can be adjusted in response to estimated expected advantage and bankroll size, though results depend heavily on probability accuracy.

It is often discussed in the context of value betting models, where the focus is on comparing estimated probability against market-implied probability.

The formula takes into consideration factors such as the size of your actual betting balance, the odds you want to bet on, and the estimated likelihood of the outcome to win.

The goal of the probability-based wager amount sizing system in sports betting is to reduce the effect of long losing streaks to avoid losing the whole betting balance.

It also adjusts stake size dynamically during winning sequences, based on the current bankroll value. Both roles of the proportional bankroll allocation method are applied with the final goal of getting the most improved long-run efficiency in the long run.

Relevant article -> Variance in sports betting and its effects.

How is statistical probability calculated?

To make sure you understand how the estimated likelihood is calculated by this Kelly Criterion tool, here is the full process:

- Both outcomes are used to figure out the house edge of the bookie

- The true odds are calculated with the help of the houses expected advantage

- The true statistical probability is calculated from these true odds

Fractional Kelly and its role

The Fractional Kelly data is 1 as a default; you do not need to include anything if you don’t want to.

Letting it be 1 means you follow the optimal staking method recommended by the original formula.

Reducing this number may lead to in using a lower % of the actual betting account balance as a stake.

Bettors with a low variance tolerance tend to use a fraction of the wager amount recommended by the calculator to lower the risks of losing the whole betting balance.

Using a smaller value than 1, such as 0.5 or 0.7 for Fractional Kelly data will also decrease the effect of variance.

Using a reduced fraction lowers exposure and volatility but also limits theoretical growth under the model.

If you need additional info on how this money management strategy works, check my dedicated Kelly Criterion capital allocation article.

What is the formula for Kelly method in betting?

The Kelly Criterion formula in sports betting can be summarized as follows:

f = (bp-q)/b

The explanation of this formula:

- f is the fraction of your actual balance typically requires allocate

- b is the odds you need to place a bet on in decimal format – 1. (For example, if the bet pays 3 to 1, then b=3)

- p is the likelihood of winning the bet

- q is the probability of losing the bet (which is 1−p)

The components of the Kelly method formula in betting:

– The numerator (bp – q) represents the mathematical expected advantage, defined as the difference between estimated probability and market-implied likelihood.

– The denominator b is the odds you’re getting on the bet, adjusted for the fact that odds are typically quoted including the return of the stake.

The result, f, represents the proportion of bankroll suggested by the Kelly formula based on the provided inputs and assumptions.

How can Kelly’s criterion be used in sports betting?

To use the Kelly Criterion in sports betting, typically requires to calculate your positive EV (expected value), also mentioned as edge, determine the odds, and apply the formula.

1. Calculate Your Edge

Calculating the positive expected value/edge over the bookmaker is the first and essential part of applying the probability-based capital allocation method properly.

This calculation is done by estimating the statistical probability of a sports outcome you want to bet on (signed as p in the formula) and comparing it with the likelihood implied by the odds offered by the bookie.

As an example, if you calculate that a football team has a true 50% chance of winning, but the sportsbook offers odds that reflect a 40% chance, you have an expected advantage.

2. Determine the odds

The easiest way to calculate the Kelly Criterion wager amount for your bet is by using odds in decimal format. In case your odds are in Moneyline or Fractional format you can use a simple odds converter and you can take the next step.

3. Apply the Formula

In the next step, you need to substitute each data/info about your betting opportunity into the Kelly Criterion formula. The result will be the percentage of your bankroll you need to use in that specific betting opportunity.

4. Calculate Your Bet Size

If you multiply the fraction obtained in the previous set from the Kelly formula by your total betting bankroll you will get the exact stake you need to use.

Your total bankroll when using the Kelly method formula for betting can be your actual balance on your bookie account or the overall money you allocate for wagering.

5. Consider Using Fractional Kelly

Sports bettors face variances daily. This betting-related phenomenon can destroy your balance even when using the probability-based stake sizing strategy.

For this reason, many bettors choose to use the so-called Fractional proportional staking method.

It means instead of using the whole stake advised by this formula, you can reduce the risked money by using half or a quarter of the recommended wager amount.

This fractional proportional bankroll allocation reduces the effect of long losing streaks. It also has the advantage of reducing the effects of a wrongly calculated positive EV of a bet.

Make sure to check the betting stake calculator combined with the value bet simulator to observe how different stake sizing approaches behave under various probability assumptions.

6. Monitor and adjust the staking

Many times, bettors don’t have the desired results even when using the most effective likelihood-based stake sizing strategy. There can be many reasons why you fail, such as not being able to define the true probability of an outcome accurately.

By monitoring your results with a spreadsheet or an automated tracking service/software for betting like RebelBetting, you can spot mistakes.

Adjusting the fraction of your proportional staking or the markets/odds ranges used in your strategy can significantly increase your long-term results.

What is an example of a Kelly method capital allocation in betting?

Football example:

– Event: A football match between Team A and Team B.

– Your Assessment: You estimate that Team A has a 50% chance of winning the event.

– Bookmaker’s Odds: the sportsbook offers odds of 2.15 for Team A’s win.

Making early calculations:

1. Determining the Variables for the formula:

– p (Your Estimated likelihood of Winning): 50% or 0.50.

– q (Probability of Losing): The complement of p, which is 50% or 0.5 (1 – 0.50).

– b (Decimal Odds – 1): For odds of 2.15, b is 1.15 (since 2.15 – 1 = 1.15).

2. Calculation:

– The formula is (bp-q)/b).

– Plugging in the values: (1.150.5-0.5)*1.15.

– The calculation becomes 0.075*1.15 = 0.0825

– So, the Kelly equation suggests you should wager 8.25% of your bankroll.

3. Determining Bet Size:

– If your total betting balance is $500, then according to the likelihood-based stake sizing formula, you should bet 8.25% of $500, which is $41.25.

Example summary:

As mentioned above, the exposure level advised by the Kelly method formula can seem high.

In this example, using a smaller wager amount would reduce exposure but also limit variance, illustrating the trade-off between risk and stake size.

Reducing the Kelly stake proportionally can lower exposure during losing streaks, though it does not eliminate the risk of drawdowns.

Is the Kelly Criterion or flat staking better?

Using the right stake sizing strategy between Kelly method and flat staking for betting depends on multiple factors, such as your balance size, variance tolerance, and the strategy you use.

We already know how the Kelly-style bankroll allocation method works, so here is a little info on flat staking.

The flat staking sports betting staking method involves wagering the same amount on every bet, regardless of your expected advantage and odds used.

1. Risk Management: While using the flat bankroll allocation method, the risk gets lower as your bankroll grows. The Kelly Criterion can result in huge wager amount when your betting balance grows.

The risk of using the Kelly method does not grow when the balance is bigger. With flat staking, on the other hand, the risk level changes all the time.

2. Profit Potential: Using Kelly style staking has a higher profit potential in the long run than flat staking.

3. Usability/complexity: The Kelly method, proportional model stake sizing method requires more effort and time investment compared to flat staking.

While following a value betting strategy, the odds are dropping fast, which makes the manual Kelly stake calculation impractical. Flat staking, on the other hand, does not require effort or time investment.

In summary, flat bankroll allocation is a more simpler to implement method, with the trade-off of lower growth potential.

The Kelly [1] sports betting capital allocation strategy is often discussed as more higher variance than flat staking under certain theoretical conditions.

Is the Kelly method wager management the best for football betting?

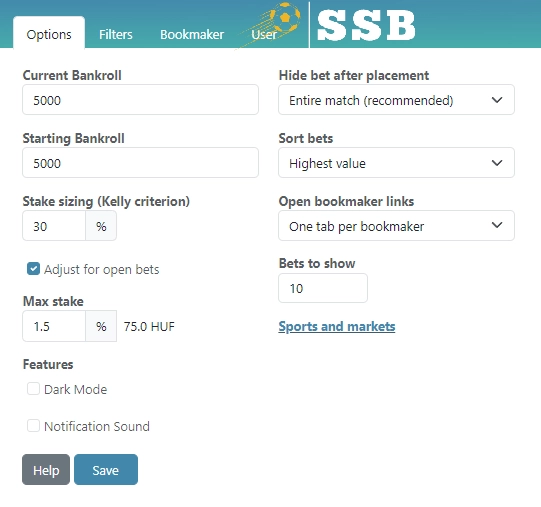

The Kelly [2] stake size management strategy is typically implemented through software tools that automate calculations, as manual application can be impractical in fast-moving markets.