Value betting is a mathematics-based betting approach that involves higher short-term uncertainty compared to outcome-covering methods such as arbitrage or matched betting.

Because this approach does not remove variance, periods of drawdown are expected even when decisions are made using sound probability estimates.

Compared to arbitrage or matched betting, placing value bets involves fewer mechanical steps, but it requires a deeper understanding of odds, probabilities, and risk management.

Below, you’ll find a comprehensive overview of how this strategy works, its limitations, and the tools commonly used to analyze it.

Resources/Guides To Value Betting

How to find value bets?

There are three primary methods commonly used to identify potential value betting opportunities.

Each method has specific strengths as well as notable limitations that should be understood before use.

Below, I outline three approaches I’ve used over the past few years that may be relevant for both beginners and more experienced bettors.

Check the in-depth guide on how to spot value betting opportunities.

Strategies to approach value betting

This guide is intended to improve understanding of how expected value concepts are applied in betting contexts.

Some approaches are relatively straightforward, while others require more advanced statistical interpretation and execution discipline.

You can follow a step-by-step walkthrough that highlights common mistakes and practical considerations when learning this strategy.

Check the in-depth guide on value betting strategies or the related topic on EV betting on exchanges.

Software to use for value betting

Each value betting software solution differs in terms of bookmaker coverage, calculation methodology, and intended user profile.

Some tools focus primarily on European sportsbooks, while others are designed for U.S.-based markets.

I tested multiple value bet finders and compared them based on factors such as scanning speed, odds accuracy, supported bookmakers, and filtering capabilities.

Check my tests about value betting software.

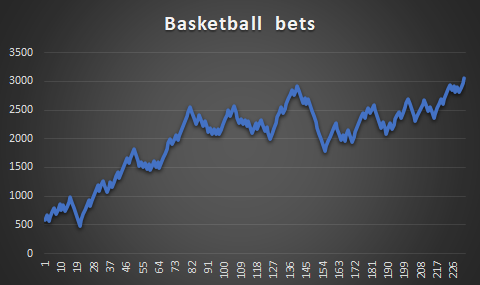

Simulate your outcomes

The potential outcomes of value betting vary widely depending on individual inputs such as stake sizing, market selection, and execution quality.

Using the value betting simulator allows you to visualize a range of possible scenarios, including both favorable and unfavorable outcomes, without risking real funds.

Losing streaks: variance in value betting

Consistently winning every bet using value betting is statistically unrealistic, and losing streaks are an inherent part of the process.

Understanding variance is essential for maintaining realistic expectations and avoiding emotionally driven decisions.

If you are uncertain about how variance affects betting outcomes, you can review the following guide on variance in value betting.

Each positive EV article on our site

- In-play Tennis Value Betting: Tips, Tricks, Traps

- CLV Sports Betting Calculator

- 8 Value Betting Software +EV Bets Finders Tested

- How to Find Value Bets: 3 Proven Methods

- The Role of Probability in Value Betting

- Value Betting on Exchanges, Sharps & Brokers

- 2 Pinnacle Dropping Odds Alert Services

- Value Betting vs Arbitrage Betting Comparison

- Variance In Sports Betting: Guide And Tips

- Best bookmakers for value betting: how to find them?

- Kelly Criterion Stake Sizing in Value Betting Guide

- 5 Value Betting Strategies & Tips

What is value betting?

Value betting is a probability-driven betting technique that focuses on identifying odds that may not accurately reflect the estimated likelihood of an outcome.

In gambling discussions, it is often stated that “the house always wins,” which reflects average outcomes across all bettors rather than optimized decision-making.

By applying structured probability analysis, bettors aim to identify situations where odds appear misaligned with statistical estimates, though this does not remove risk.

Value betting involves identifying outcomes where the offered odds imply a lower probability than what statistical models or reference markets suggest.

Placing bets under these conditions may improve expected outcomes over large samples, but individual results will always vary.

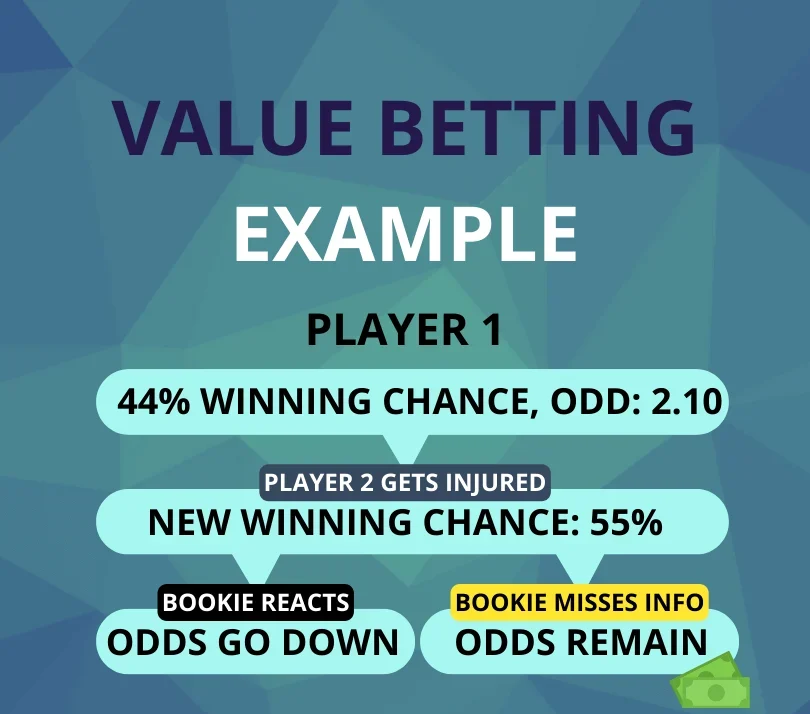

What is an example of value betting?

Below is a simplified illustrative example of how a value betting situation might arise:

- Tennis player Novak Djokovic is scheduled to play against Daniil Medvedev

- Market odds suggest Medvedev has approximately a 44% implied probability to win, reflected by odds of 2.10

- New contextual information (such as fatigue, injury concerns, or scheduling factors) may alter the estimated probability

- If independent analysis suggests Medvedev’s actual chance is closer to 55%, the odds may no longer reflect the updated probability

- In this scenario, the discrepancy represents a theoretical value opportunity, not a guaranteed outcome

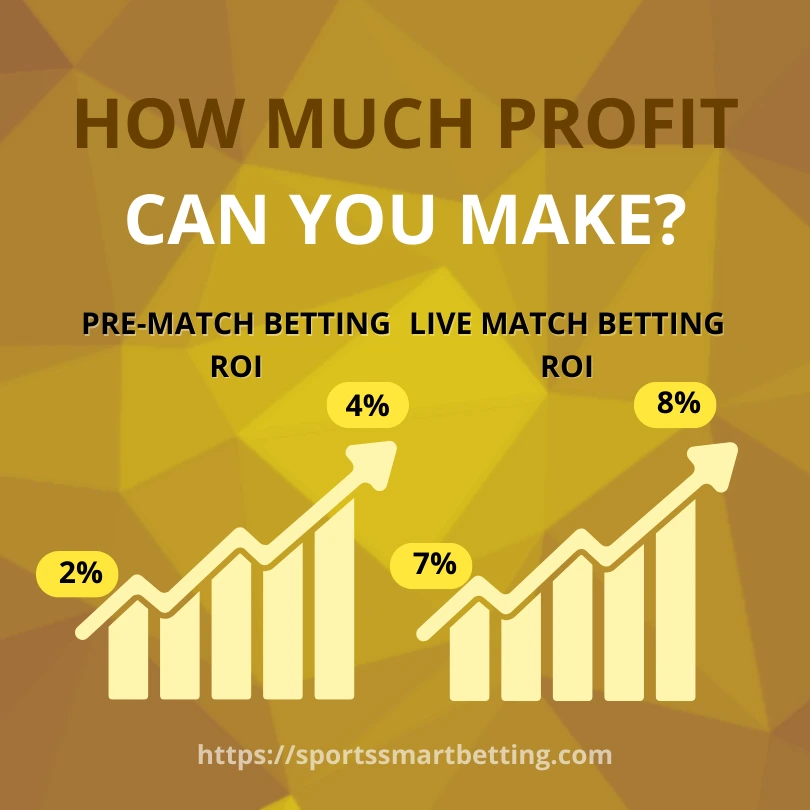

How much can you make with a value betting strategy?

For pre-match value betting, observed long-term ROI figures are often cited in the range of 2%–4%, though this varies significantly.

In live betting environments, returns may occasionally be higher due to faster-moving markets, but execution difficulty and variance also increase.

ThKey factors influencing results include:

- The number of bookmakers and betting accounts available

- The size and management of the betting bankroll

- Stake sizing and money management strategy

- The analytical tools used to assess odds

- The impact of variance and losing streaks

- The amount of time invested in analysis and execution

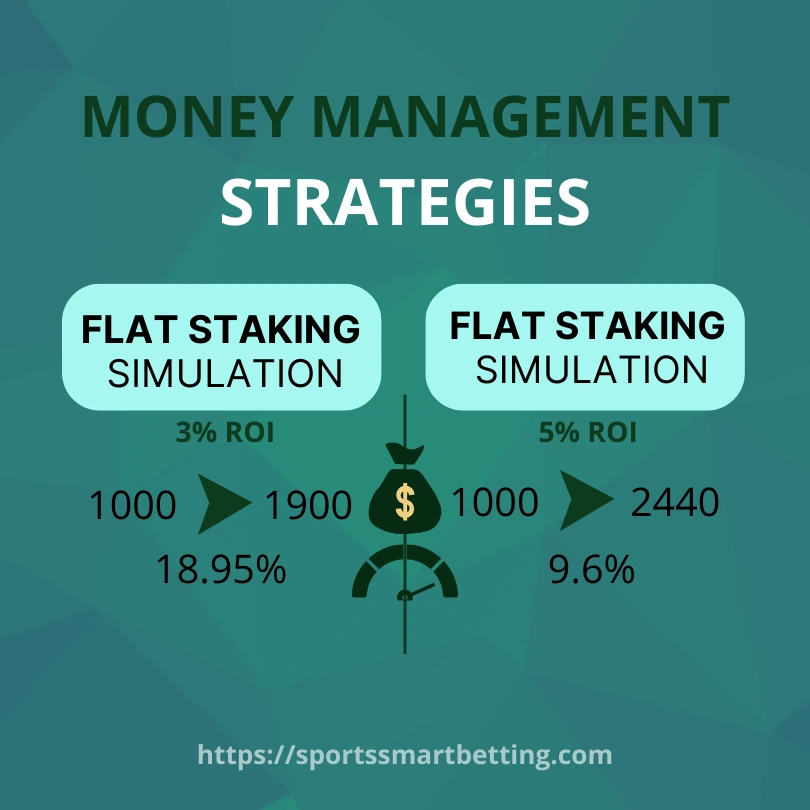

How much money do you need to start value betting?

Value betting generally requires less starting capital than arbitrage betting, and some bettors begin with as little as $200–$300.

However, larger bankrolls allow for smoother stake distribution and reduce the impact of variance on short-term results.

For example, starting with $1,000 and rolling over that bankroll multiple times per month at a modest average ROI illustrates how turnover influences outcomes, not guaranteed profit.

Value betting results are closely tied to how frequently capital is deployed and recycled over time.

Having access to a larger bankroll (such as $2,000–$3,000) may allow for more frequent participation without waiting for individual events to settle.

As the number of bets increases, results become more statistically representative, but time commitment and execution quality remain critical considerations.

Time investment should be evaluated carefully, as extended sessions and high volume increase cognitive load and operational risk rather than ensuring better outcomes.